With the closure of Toys R Us and its affiliate brand Babies R Us, the retail landscape for infant and child products is undergoing a shift that could allow for other retail giants like Target and Amazon to move in and dominate or it could be a call to action for smaller specialty retailers to get into the game. It’s a time of opportunity for brands to move into the US market for toys and baby care products now that the iconic giraffe is no longer leading the pack.

Recently, Walmart, not known for being a player in the juvenile products retail market, introduced a highly personalized baby registry for expectant parents. The registry is online, and the company has added mobile enhancements within the Walmart app. Parents use a cute chatbot called “Hoo the Owl” who leads them through questions on gender, due date, and product favorites and then populates the registry with items based on their preferences. Gift givers can access the registry through the app as well, to shop for items, scan receipts when an item is purchased, and check store availability.

Walmart has also partnered with some newer brands. BOB, Jujube, nanobébé, Owlet, and Hello Bello items have all been added to offerings on Walmart.com. Chicco, Monbébé, Britax and the Halo Bassinest are in over 2,000 brick and mortar locations. While there is significant growth happening in e-commerce channels for baby care products, in-store experience still rules the day. Diapers and baby gear firmly hold on to more than 75% of the baby products market - giving brands two opportunities for in-store sales.

A parent looking for the right crib or the safest car seat is on a mission; these are serious researchers and they want the hands on experience of seeing the product they may use for 3, 5, or more years. Alternatively, while parents may have diapers shipped to their doorstep, there will always be the unprecedented last minute diaper run, giving brands and retailers the opportunity to up-sell mom and/or dad while they are in-store.

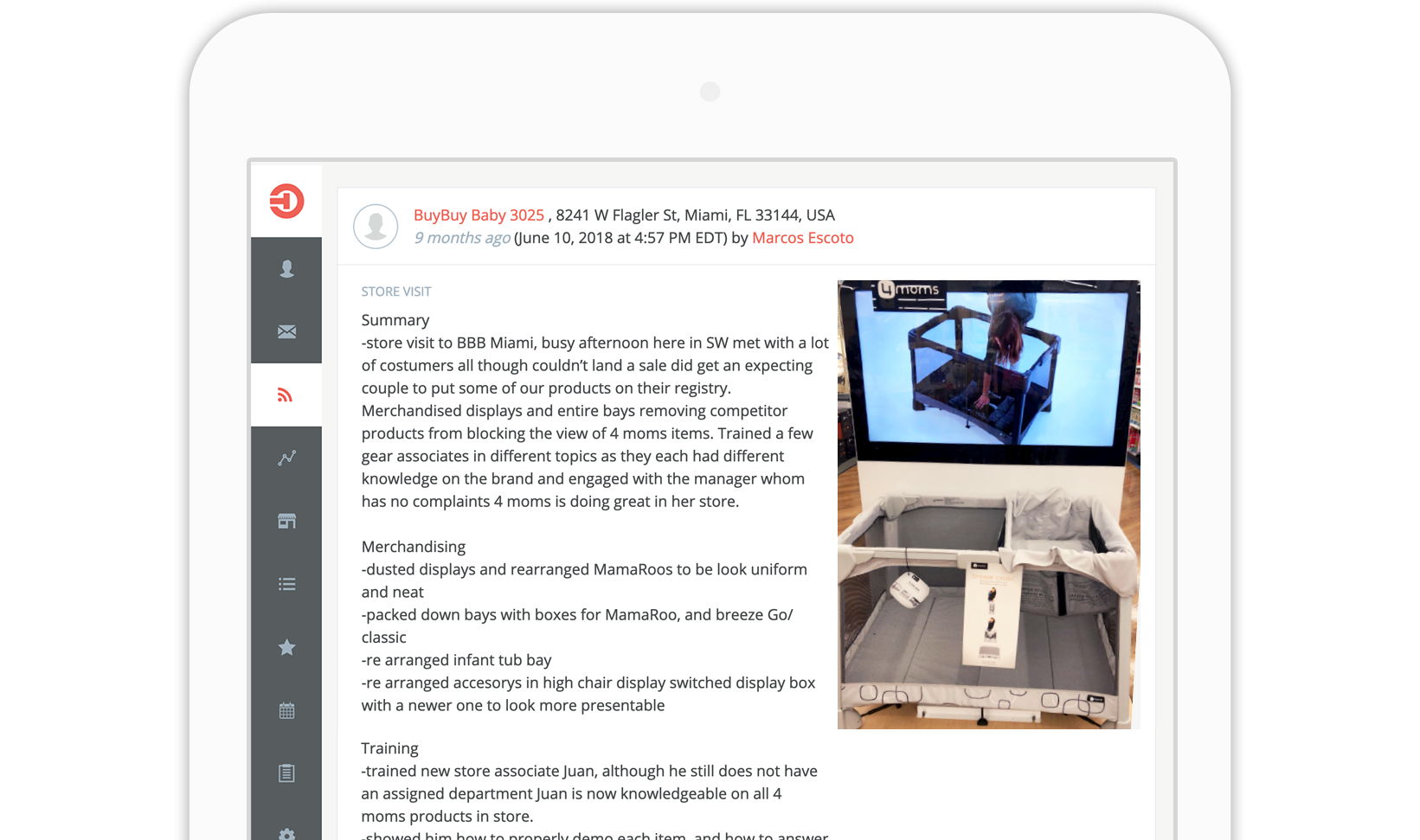

But brands don’t just have to be available, they have to come with data, and there needs to be a dependable associate or brand rep available to educate and help consumers, with visible, organized sales floor placement. If you’re a brand that makes a new, high-tech line of infant and toddler furniture like cribs and rockers, with integrated features like Bluetooth and ergonomic design, the features your products have should be highlighted with signage, interactive displays and most importantly, educated staffers that are passionate about the products and can answer all the questions most (and likely anxious) parents will have. Very, very few parents buy something they haven’t researched, picked up, touched and tried - from a $4.97 pack of diapers to a $1,099 travel system.

And finally - timing is everything. Having a field force in place during strategic times in-store ensures that customers out hunting for that perfect bunting and the safest stroller will see your brand and be able to speak to reps who know every last detail on why your items are the ones they need. Market research shows that between 2 pm and 4 pm on any Saturday or Sunday, 11.6% of Americans can be found shopping in a store. On weekdays, the percentage is highest around the lunch hours from noon to 2 pm, to accommodate work schedules. While many consumers will dig a little deeper into their wallets to buy a better product, time is a precious resource shoppers can’t just get more of.

Having your brand’s baby booties on the ground and rubber duckies in a row is a crucial element of gaining market share. Worried about how your brand will perform this year? Connect with the team at ThirdChannel and let's have a conversation around our people, tech, and data solutions.