When you arrive at work in the morning, what tactics do you use to make sure you’re focused on the most important items? Maybe you use to-do lists, or perhaps you keep a planner. Whatever the system, your goal is probably to focus not only on the most pressing activities, but also the ones that will have the biggest positive impact on the business.

As a retail brand manufacturer, you should have that same goal for your field agents. Field agents aren’t only the brand’s eyes and ears on the ground in stores across the country; they’re also the people who are in the best position to fix retail execution issues and make sure you’re receiving the most from your in-store promotions, merchandising and products.

At a time when only 20% of consumer goods companies1 are satisfied with their ability to execute on-the-ground, it makes sense for brands to ensure that field agent time is focused on the activities that will have the biggest positive impact on the business.

How do you do that? With data, of course.

Action Plan Quadrants

Data fuels selective retail management. While it would be nice to wave a magic wand and fix all retail execution issues at every store, it’s far more economical and strategic for brands to figure out which stores offer the best potential for sales growth and identify the improvements that would go furthest toward helping those stores reach that potential.

ThirdChannel does this by helping brands score their stores. By analyzing multiple dimensions of on-the-ground and sales data and then identifying the top drivers for in-store sales, brands can identify which stores in their network do the best job of hitting those marks, and which need improvement.

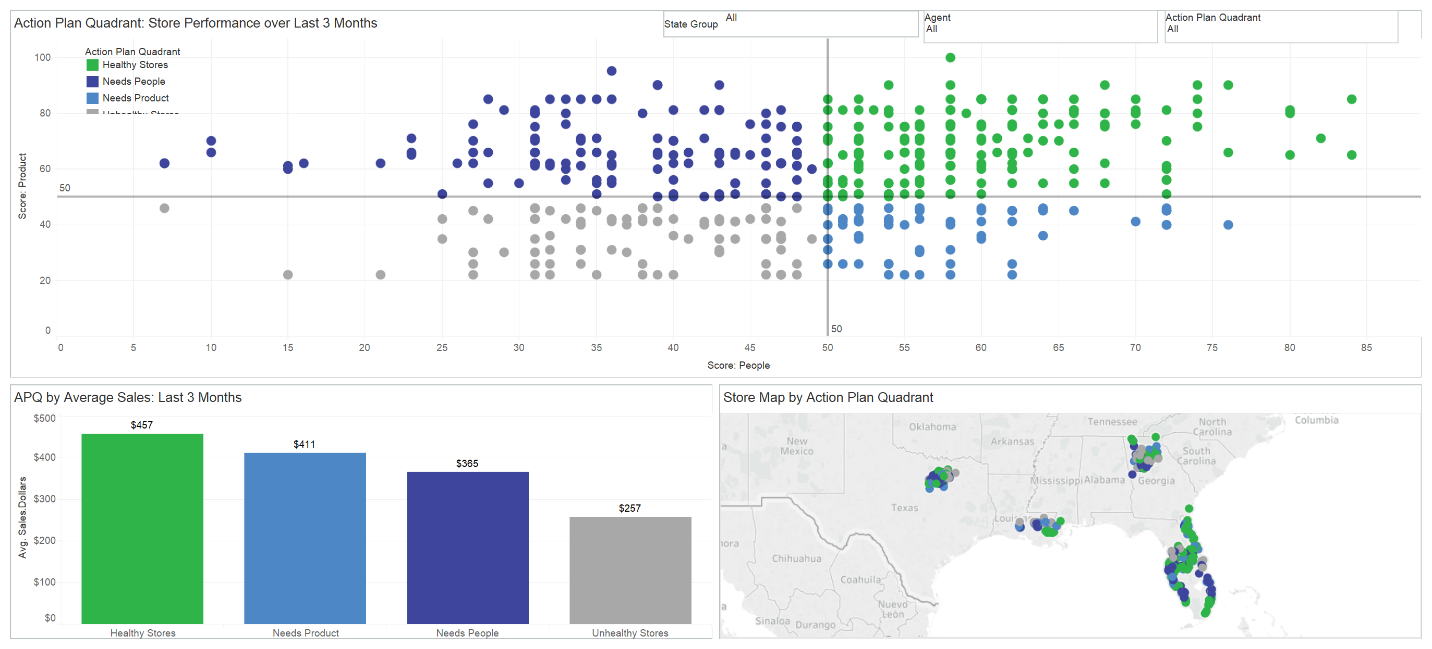

From there, brands can develop an Action Plan Quadrant, which plots store needs based on two factors – people needs and product needs. A store that is hitting all its targets in terms of product (great merchandising, inventory, POP, signage, and other similar factors) as well as people (well-trained store associates, positive customer engagement, etc.) is a success, and only needs ongoing maintenance. But, a store that lags behind in either people or product (or both) can be proactively targeted for improvement.

Putting the Data to Work

The Action Plan Quadrant essentially segments a brand’s store network based on the store conditions that are most closely linked to sales performance, which makes it easier to communicate priorities to field agents. Here’s how it works in practice.

Through this process, one national sporting goods brand was able to identify that stores with weak intrapersonal capabilities significantly underperformed its healthiest stores by about 22% in average sales. In response, the brand wanted to improve store associate education and increase the number of shoppers engaged, and for good reason. ThirdChannel’s research has found that educated employees can increase sales by up to 60%. In line with that finding, 90% of consumers report being somewhat likely or extremely likely to make a purchase after receiving help from a knowledgeable store associate.

Having identified these directives, the brand created specific action plans for its field agents:

- Train at least four store associates per visit

- Encourage associates to test out the brand’s products so they could experience it for themselves and better communicate its benefits

- Visit stores during peak hours to interact with more shoppers

- Engage with 10 or more shoppers per visit to influence more brand sales

The program was a success. After following the steps in the action plan, field agents were able to increase associate education, improve customer engagement, and increase sales in these stores.

Ultimately, the story proves that selective retail actions can turn a previously weak store into a strong performer. Things get even more interesting when you use data on sales drivers to get proactive, designing in-store experiences that push the boundaries of what’s possible in your strongest performing stores. Retail data intelligence is revealing new possibilities like these every day.

[1] Vendor Panorama for Retail Execution and Monitoring in Consumer Goods 2017.